What do some of the world’s most influential billionaire philanthropists such as Bill Gates, Ray Dalio, Jack Ma, Mark Zuckerberg, and Priscilla Chan have in common? All of them have used Donor-Advised Funds (DAFs).

DAFs are a flexible and effective way for wealth owners to structure their philanthropic pursuits. They allow donors — whether individuals, family offices, foundations, or corporations — to contribute to various causes while benefiting from administrative convenience, cost savings, and potential tax advantages.

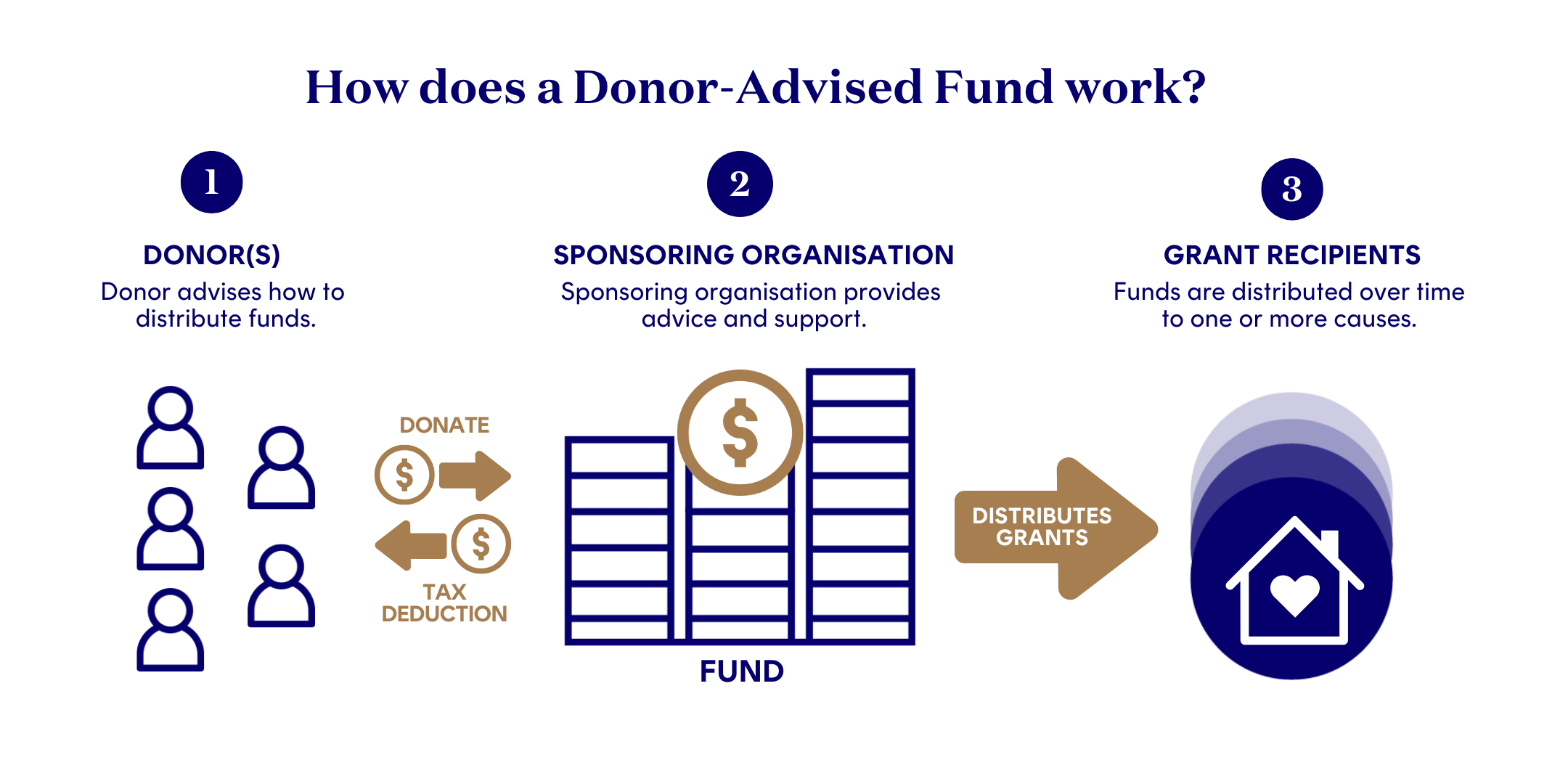

How do Donor-Advised Funds Work?

A Donor-Advised Fund (DAF) is a simple and flexible way to manage charitable giving. It allows donors to set up a named fund, make a charitable contribution, receive an immediate tax deduction, and then recommend grants to their favourite charities over time.

Once a donor contributes assets like cash or stocks to a DAF, the money could be invested and can grow tax-free. Donors can then advise how and when the funds are distributed to support various charitable organisations.

This structure offers a strategic approach to philanthropy, giving you control over when and where your donations go while maximising tax benefits.

Source: 'DECODED: Donor-Advised Funds in the Asia-Pacific', Centre for Asian Philanthropy and Society

This giving vehicle allows for long-term donation tracking while providing an effective yet powerful way for donors to support a wide range of causes according to their interests and at their own pace. If privacy is important to the donors, they can choose anonymity with each grant by not revealing the fund’s name.

It is particularly advantageous for families making multiple grants, allowing them to focus on their philanthropic goals without the costs and complexities of managing a private foundation.

Rise and Growth of Donor-Advised Funds in Asia

The growth of DAFs in Singapore and Asia mirrors trends in the US and UK. In 2022, DAF grantmaking in the US increased by 9% to US$52.16 billion1, with 1.9 million accounts each averaging US$117,0002. In the UK, grants from DAFs to other charities were £554.7 million, an increase of 21% over the prior year3.

This trend has made structured philanthropy more accessible to a broader range of donors, not just ultra-high-net-worth individuals.

Singapore, as a regional philanthropic and wealth management hub, is well-positioned for similar growth. With incentives like a 250% tax deduction that can be carried forward for up to five years, combined with a stringent code of governance for charities, Singapore offers a conducive environment for strategic philanthropy.

By the end of 2023, there were about 1,400 family offices in Singapore, with many seeking advice on fulfilling local spending requirements and leveraging philanthropy to achieve both personal and corporate goals. Oftentimes, a DAF can provide a cost-effective and flexible solution.

While nascent, Singapore’s DAF ecosystem can become a leading platform for strategic giving, enhancing the philanthropic sector and supporting a vibrant non-profit environment.

TT Foundation Advisors: Mainstreaming Philanthropy Advisory Services in Asia

Launched by Temasek Trust in April 2024, TT Foundation Advisors (TTFA) provides specialised philanthropy advisory and management services to philanthropists, private foundations, family offices, and corporate foundations across Asia.

Led by Mr Dickson Lim, TTFA partners with clients to drive meaningful change by providing personalised advisory services, innovative tools, and frameworks to measure and amplify the impact of their giving.

TTFA clients benefit from Temasek Trust’s extensive networks and resources, including impact measurement and management training and insights from Temasek Trust ecosystem entities such as the Centre for Impact Investing and Practices and the Asia Centre for Changemakers. They can embark on collaborative philanthropic projects and initiatives via the Philanthropy Asia Alliance and access curated global impact opportunities on Co-Axis, a digital catalytic capital marketplace matching impact projects and funders.

In July 2024, TTFA partnered with Mizuho Bank Singapore to launch the Mizuho Singapore Foundation, a US$1 million DAF supporting local philanthropic initiatives. From advisory services to seamless execution, TTFA is providing companies like Mizuho Singapore with the tools and expertise they need to make a lasting difference in the community.

As the demand for philanthropy advisory services grows, TTFA aims to be a one-stop provider of philanthropic advisory and management services ranging from strategic planning and programme curation to governance and impact management, helping clients deliver meaningful solutions to the communities they care deeply about.

Follow TTFA on LinkedIn for the latest updates. For more information, reach out to TTFA at [email protected].

Stay connected with the Temasek Trust ecosystem by following us on LinkedIn, Instagram, Facebook, and YouTube.

1 The 2023 DAF Report, National Philanthropic Trust

2 ‘Accelerating Donor Advised Funds for Philanthropic Impact in Singapore and Asia', Wealth Management Institute

3 8th Annual UK Donor-Advised Fund Report, National Philanthropic Trust UK