The world faces a multi-trillion-dollar annual funding gap — and we are not narrowing it fast enough. To achieve the UN Sustainable Development Goals (SDGs) by 2030, between US$2.5 trillion and US$4 trillion in financing and investments need to be mobilised globally per year1.

Tackling complex, urgent challenges such as climate change, poverty, and inequality requires innovative and holistic solutions. On their own, traditional funding sources such as government grants and charitable donations are often insufficient to scale these solutions.

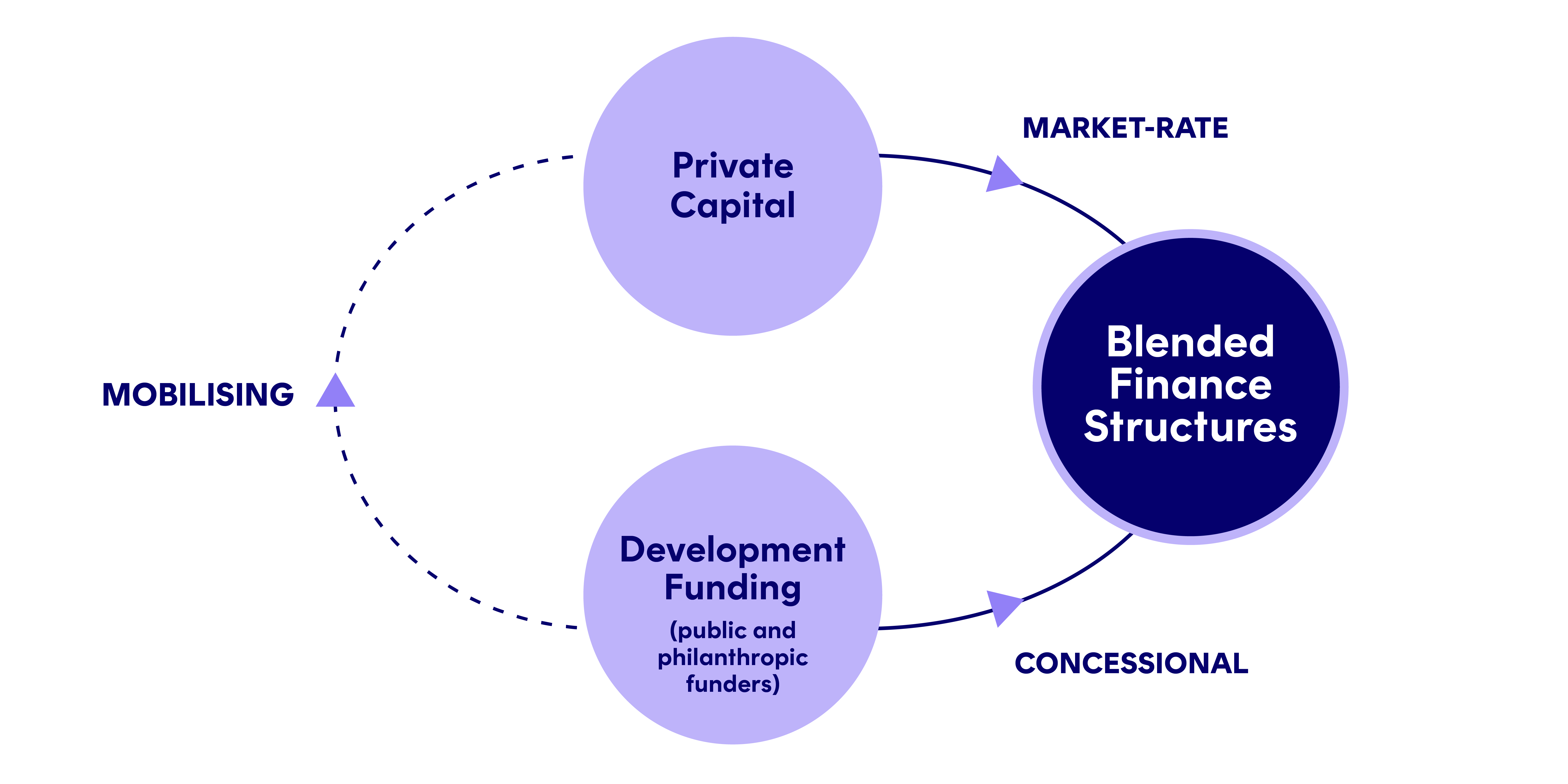

This is where blended finance can come in. Blended finance is a strategic way to combine different types of funding from sources like governments, philanthropists, and private-sector organisations. By bringing together money with these varying risk levels, it also promotes collaboration across sectors. This approach enables marginally unbankable opportunities — such as startups, scaleups, infrastructure projects, services projects, social enterprises — to tap into larger and more diverse pools of capital, ultimately scaling social and environmental impact.

Source: Illustration adapted from Convergence Finance.

However, blended finance remains under-utilised globally. Between 2015 and 2020, average annual flows of blended finance globally stood at less than US$10 billion2. That is a fraction of the trillions of dollars required annually in developing countries to meet the SDGs3.

Achieving this scale cannot be done through commercial capital alone, as investors seeking market-rate returns are often deterred by the perceived risks and lower initial returns associated with sustainable development projects.

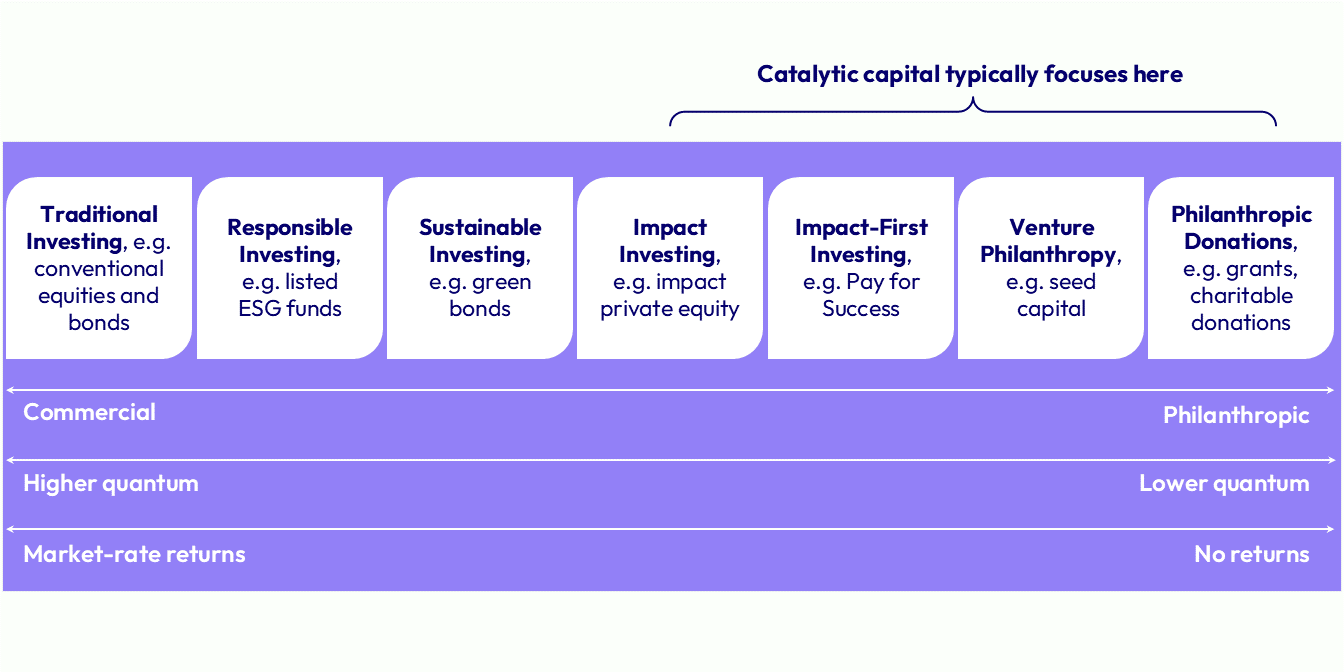

Catalytic capital helps narrow this gap by complementing other types of funding. Blended finance pools catalytic capital with other resources to drive sustainable impact at scale.

What is Catalytic Capital?

Catalytic capital is patient, risk-tolerant, concessionary, and flexible in that it can be used alone or to enable market-rate investors to co-invest.

It aims to scale impact by accepting disproportionately more risk and/or concessionary return, and can come in the form of financial instruments such as equity, loans, guarantees, and grants. The goal is to attract more investments that would otherwise not be possible.

Source: Tri-Sector Associates

This comes as a new wave of wealth owners want to do good, differently. In Asia’s philanthropic sector, there is a growing desire for collaboration among donors and across sectors, a shift towards strategic philanthropy with a focus on impact, and a greater emphasis on social and environmental issues.

Check out our comic strip explainer about how philanthropic capital can catalyse additional support from other sectors to accelerate climate action: The Superpower of Philanthropy

How Does Blended Finance Work?

Imagine a community garden. The land, like philanthropic or catalytic capital, provides the initial investment and foundation to kick off the project. Seeds and plants represent private investment, supplying the essential resources to grow the garden. Community support, akin to public-sector funding, can offer additional resources such as tools, water, or expertise to start and later expand the project.

Together, these elements create a thriving garden, benefiting the community and the environment. It may even inspire others to start their own community gardens in other parts of the neighbourhood.

Blended finance works in a similar way, combining resources from different sectors to enable impact-focused projects to scale. This can help de-risk projects, improve their financial viability, reduce investment costs, and catalyse further support from other funders.

Here are five risk-tolerant instruments commonly used in blended finance:

- Grants, including recoverable, recyclable and convertible grants

- Debt at below-market interest rates, including subordinated or first-loss debt and impact-linked loans

- Equity with asymmetrical returns

- Guarantees, which are particularly apt for infrastructure projects

- Insurance at below-market rates, such as for political insurance or currency risk

- Technical assistance facilities, which strengthen commercial viability, reduce risk, and enhance developmental impact.

Blended finance can be structured in different ways to address specific investment barriers, such as high risks, limited technical expertise, low returns, and high transaction costs.

For example, some investors may find early-stage, impact-driven startups too risky. Blended finance can help to mitigate these risks through guarantees, insurance, or concessional financing.

Certain funders may also lack the know-how to evaluate and manage impact-focused projects. Blended finance can provide technical assistance and capacity building to support these projects.

Blended Finance in Action

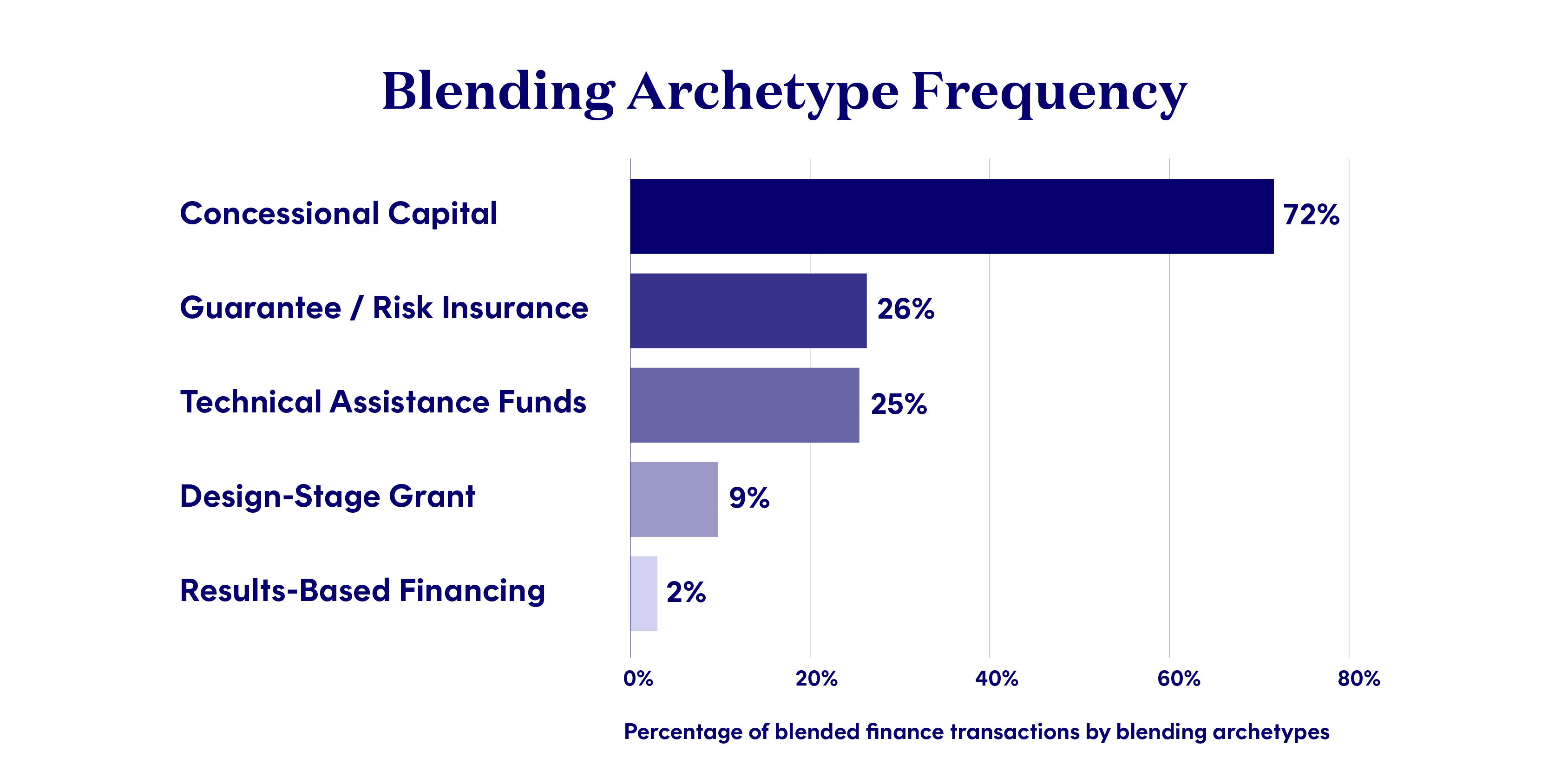

Depending on how they are structured, blended finance transactions may involve various types of funding, such as concessional capital, results-based financing, and technical assistance funds.

Source: Convergence Finance, as of 12 Sep 2024

1. Concessional capital: Subsidised funding for impact-focused projects

Concessional debt or equity is the most common type of funding in blended finance transactions, as the chart above shows.

It is typically provided by governments, development banks, and philanthropic organisations to support projects that create a positive social or environmental impact but may not be financially viable on commercial terms alone.

Concessional capital is provided on terms that are more favourable than those available in the commercial market — such as lower interest rates, longer repayment periods, or grace periods — to accelerate development objectives.

For example, this could come in the form of a loan that has a below-market interest rate and needs to be repaid in 20 years instead of 10, to finance a sustainable agriculture project.

Blended finance transactions may combine concessional loans with grants and equity investments with market-rate return from private-sector investors.

2. Technical assistance funds: Addressing the pipeline problem

A significant barrier in impact investing is the lack of investment-ready projects due to inadequate preparation and structuring. Investors often raise funds but find it difficult to identify viable projects to finance.

Technical assistance funds and preparatory grants address this by financing early-stage project development and implementation activities, such as feasibility studies and project structuring. This makes the projects more attractive to private investors, growing a pipeline of investible opportunities.

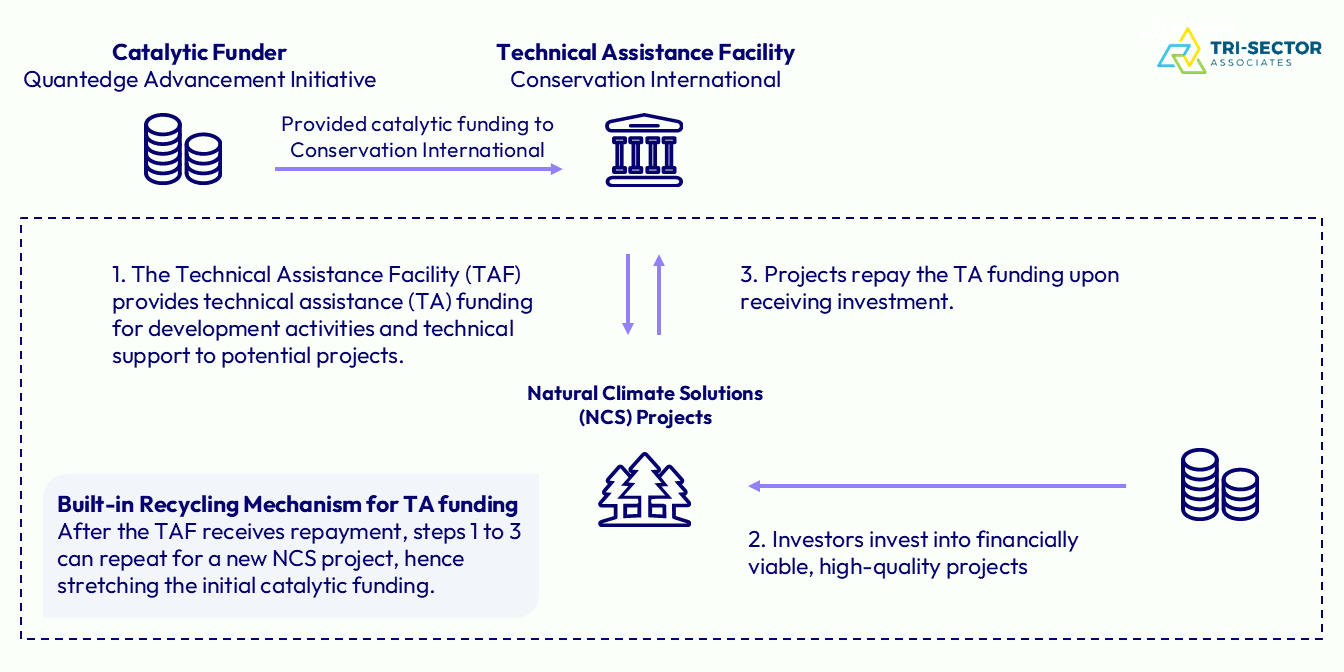

An example is Conservation International Asia-Pacific’s Natural Climate Solutions Technical Assistance Facility, supported by family offices. The facility provides crucial funding and technical support to de-risk and create a pipeline of high-quality, natural climate solutions (NCS), which protect, restore, and sustainably manage natural ecosystems to contribute to climate mitigation efforts.

Source: Tri-Sector Associates

The technical assistance facility provides funding for project design and capacity building in areas such as technical, scientific, policy, and communications capabilities. It pools funds from various funders and allocates them to the highest-priority sites or projects, making the fundraising process easier.

Tri-Sector Associates — part of the Temasek Trust ecosystem — designed this facility in partnership with Conservation International Asia-Pacific, to help expand the pipeline of investible NCS projects in Southeast Asia and attract new types of funders who are interested in NCS investments, by increasing the investment potential of such projects.

3. Results-based financing: Paying for success, making projects viable

Many social impact projects are not financially sustainable because their social benefits are not properly compensated, making them unattractive to private investors.

Results-based financing, also known as outcomes-based funding, addresses this. By tying funding to specific, measurable outcomes, it means that projects are only funded if they deliver the desired results — such as reducing poverty, improving health, or protecting the environment.

This ensures the money is used effectively and projects are accountable, incentivising performance and making projects more attractive to investors.

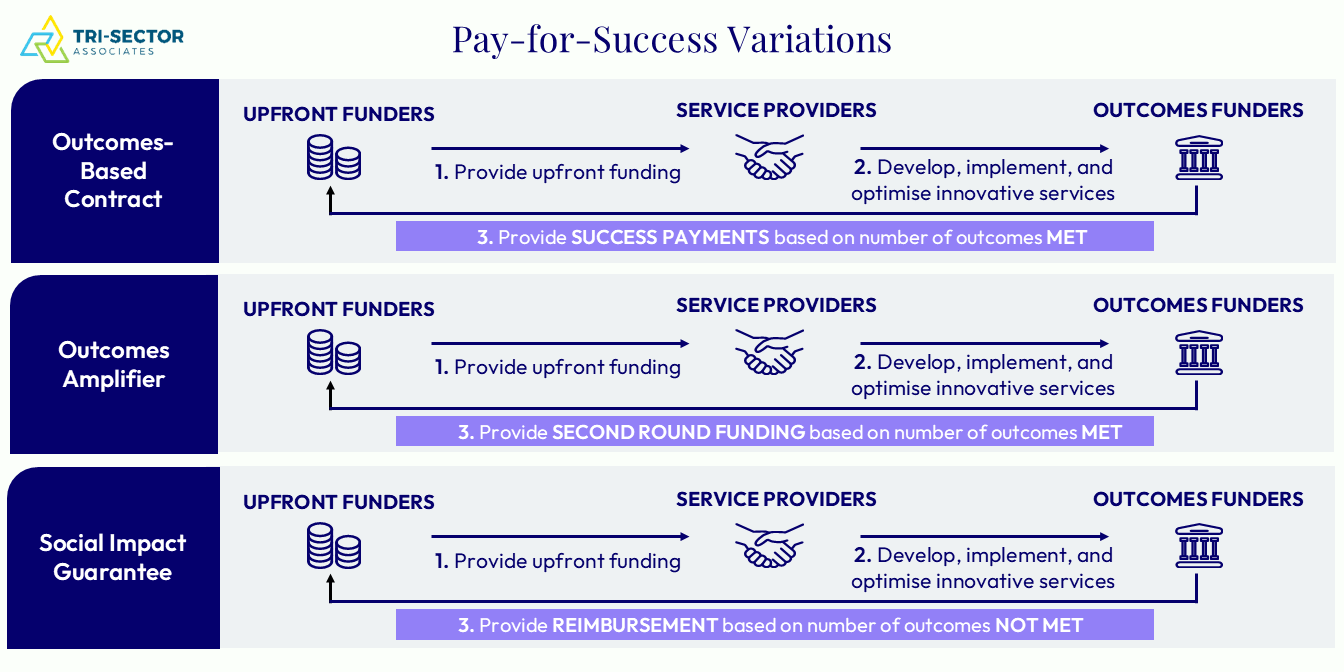

Pay-for-Success (PFS) is a results-based financing model whereby an investor pays upfront for the costs of an intervention. The outcomes are measured by clear, predetermined metrics. After that, the outcomes funder, usually a philanthropic organisation, a public sector entity or a development agency, repays the investor and/or provides a return on the investment if the pre-agreed outcomes are achieved.

An example is non-profit Trampolene’s GATES programme, which offers high-skilled employment for persons with disabilities. The initiative helps tertiary-educated individuals with autism spectrum disorder attain high-skilled engineering jobs.

In this case, the metrics include the number of successful employment placements with three-month retentions and nine-month retentions.

Variations of Pay-for-Success include an Outcomes-Based Contract, Outcomes Amplifier, and Social Impact Guarantee. Source: Tri-Sector Associates.

In Singapore, AWWA, a social service agency, developed the Family Empowerment Programme (FEP), which aims to provide more understanding towards how longer-term income predictability could empower low-income families to pursue their medium- to long-term goals.

The FEP is based on a Pay-For-Success model, namely the Outcomes Amplifier variation, with Tri-Sector Associates as technical advisors, upfront funding from Standard Chartered Bank, and outcomes funding from Temasek Trust.

The programme received initial funding from Standard Chartered Bank. As specific outcomes — focused on education, skills upgrading and employment — were achieved, Temasek Trust will fund a second leg of the project, enabling the FEP to be refined and expanded.

Structuring Cross-Collaboration for Good

Blended finance provides an avenue for diverse stakeholders — including governments, companies, philanthropists, and nonprofits — to leverage their combined strengths and expertise in tackling development challenges.

Tri-Sector Associates, part of our Temasek Trust ecosystem, is a nonprofit end-to-end impact advisory that structures cross-sector collaboration to accelerate impact. It unites together the government, private sector, and civil society organisations on a shared journey to co-create innovative solutions with measurable outcomes towards aligned goals.

To learn more, visit Tri-Sector Associates' website and follow them on LinkedIn.

For the latest updates on Temasek Trust and our ecosystem, follow us on LinkedIn, Instagram, TikTok, Facebook, and YouTube.

1 Annual SDG Financing Gaps Measured in Trillions: FSDR 2024, SDG Knowledge Hub

2 "Tiny but Mighty – Scaling Blended Finance in Asia", Monetary Authority of Singapore

3 New UN report calls for trillions more in development investment to rescue SDGs, UN